Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

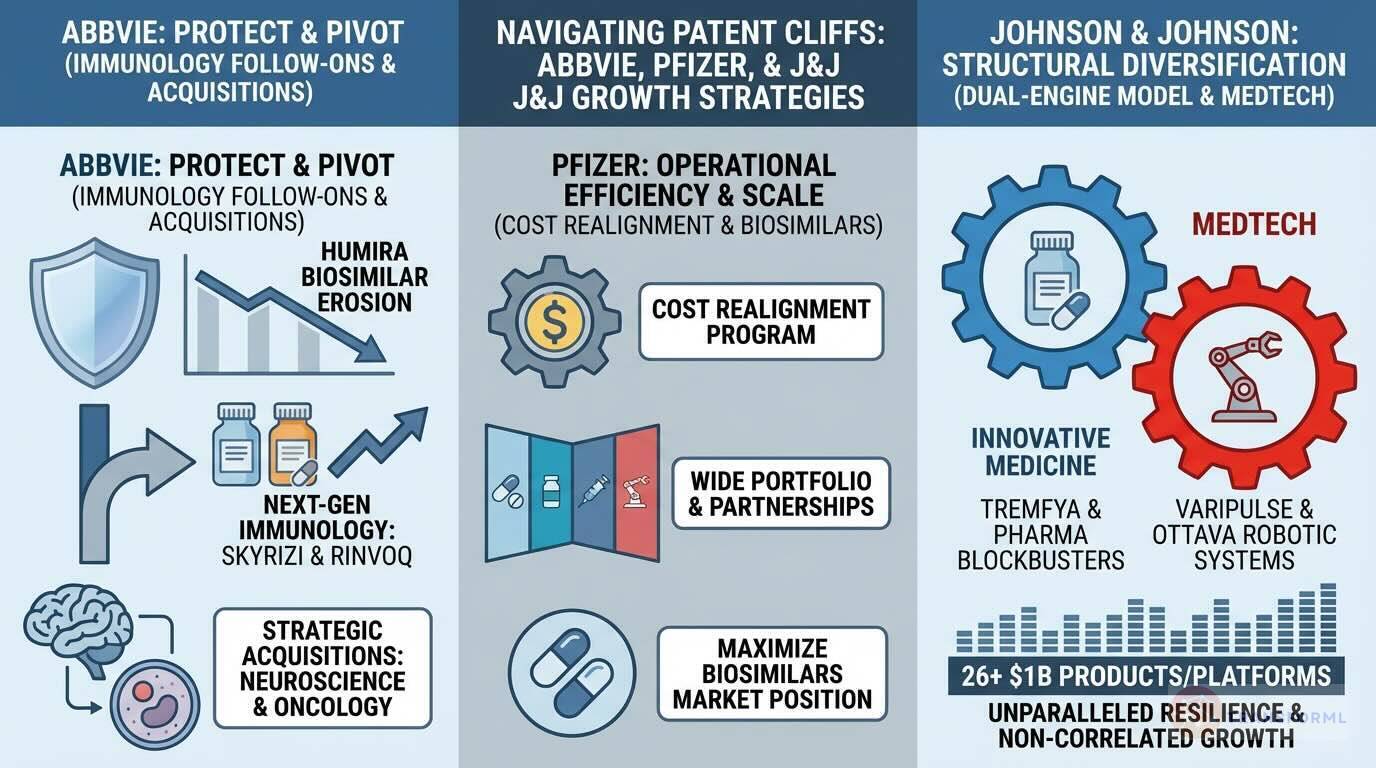

How are AbbVie, Johnson & Johnson, and Pfizer using different approaches—from immunology follow-ons to MedTech diversification—to navigate patent cliffs and build their next wave of growth?

AbbVie and Pfizer are tackling patent cliffs primarily within the pharmaceutical domain, but with different tactics. AbbVie's strategy is a highly focused "protect and pivot" maneuver. It has an explicit strategic goal to "Effectively Manage Humira Biosimilar Erosion" by executing a well-defined plan to "Transition Patients to Next-Generation Immunology Products" like Skyrizi and Rinvoq. This defensive move is paired with an offensive one: using strategic acquisitions to build out new growth pillars in neuroscience and oncology. Pfizer, with its immense scale, is taking a broader operational approach. It is focused on efficiency through its "Cost Realignment Program" and aims to extract maximum value from its wide portfolio and leadership in partnerships, while also playing offense by seeking to "Maximize Biosimilars Market Position" with its own products.

Johnson & Johnson's approach to navigating patent cliffs is fundamentally different and is rooted in structural diversification. Its "dual-engine" model, combining a massive Innovative Medicine division with a world-leading MedTech business, provides unparalleled resilience. While one part of the company focuses on growing pharmaceutical blockbusters like TREMFYA, the other is launching completely separate, non-correlated products like the VARIPULSE platform and the Ottava robotic surgical system. With 26 different products and platforms each generating over $1 billion in annual sales, J&J is insulated from the intense pressure of any single patent expiration. While AbbVie and Pfizer's strategies are centered on defending and replacing pharmaceutical revenue, J&J's strategy relies on an entirely separate and powerful growth engine to ensure long-term stability.

Review detailed strategy and competitive analysis of companies in Pharma & Biotech

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.