Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

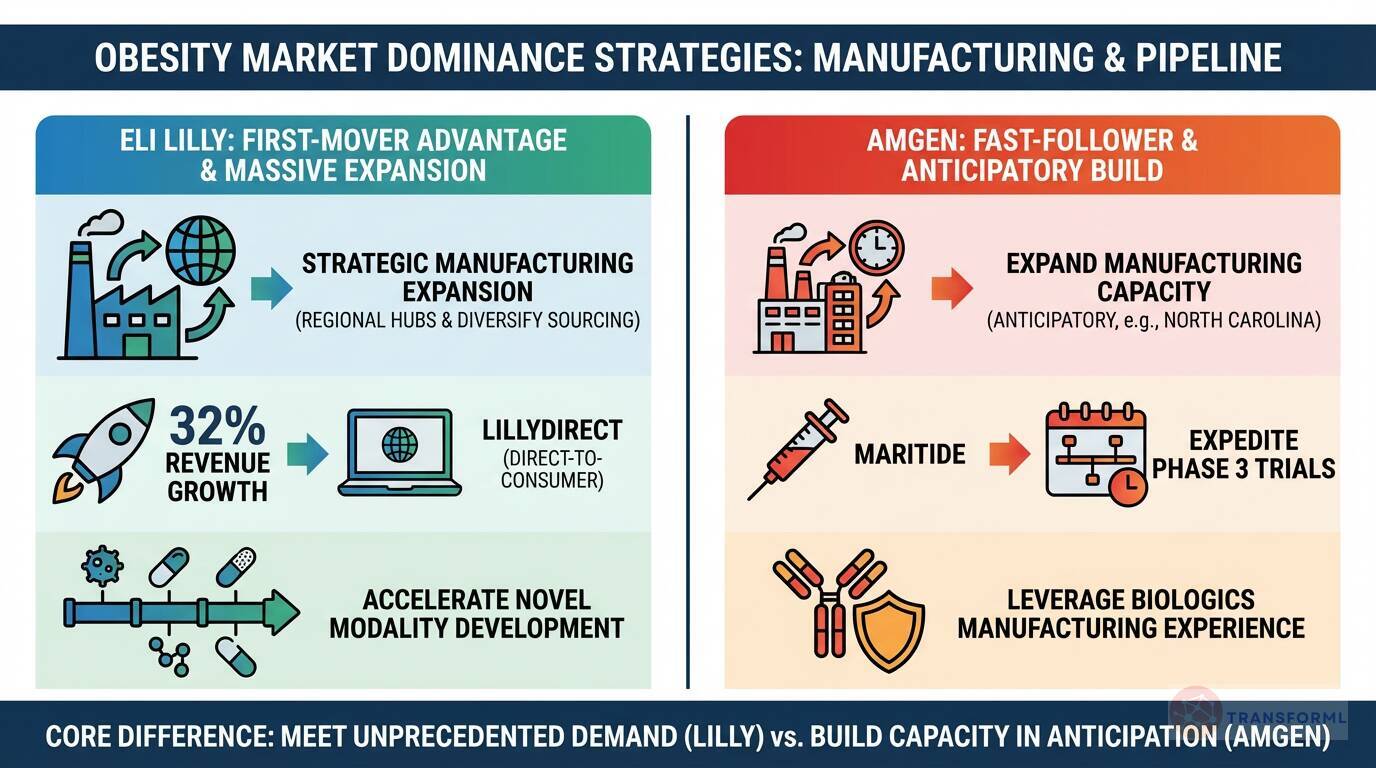

How are Eli Lilly (Zepbound) and Amgen (MariTide) building manufacturing and pipeline strategies to dominate the future of the obesity market?

Eli Lilly is aggressively capitalizing on its significant first-mover advantage in the obesity market with its blockbuster GLP-1 drugs, Zepbound and Mounjaro. The company's strategy is centered on a massive "Strategic Manufacturing Expansion" to meet the unprecedented demand that is driving its explosive 32% revenue growth. To achieve this, Lilly is pursuing goals like "Establish Regional Manufacturing Hubs" and "Diversify Raw Material Sourcing" to ensure a reliable global supply. This market-shaping approach is complemented by a bold channel innovation, "LillyDirect," a direct-to-consumer platform that bypasses traditional intermediaries, and a pipeline strategy focused on "Accelerate Novel Modality Development" to build upon its current success.

In contrast, Amgen is executing a "fast-follower" strategy, aiming to enter the hyper-competitive obesity market with its pipeline candidate, MariTide. A central objective is to "Expedite MariTide Phase 3 Trials" to bring the drug to market as quickly as possible. To prepare, Amgen is making major upfront investments to "Expand Manufacturing Capacity," including optimizing and advancing new facilities in North Carolina. While Lilly's manufacturing efforts are a direct response to overwhelming existing demand, Amgen is building capacity in anticipation of a future launch, leveraging its deep experience in biologics manufacturing to challenge the established market leaders.

Review detailed strategy and competitive analysis of companies in Pharma & Biotech

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.