Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

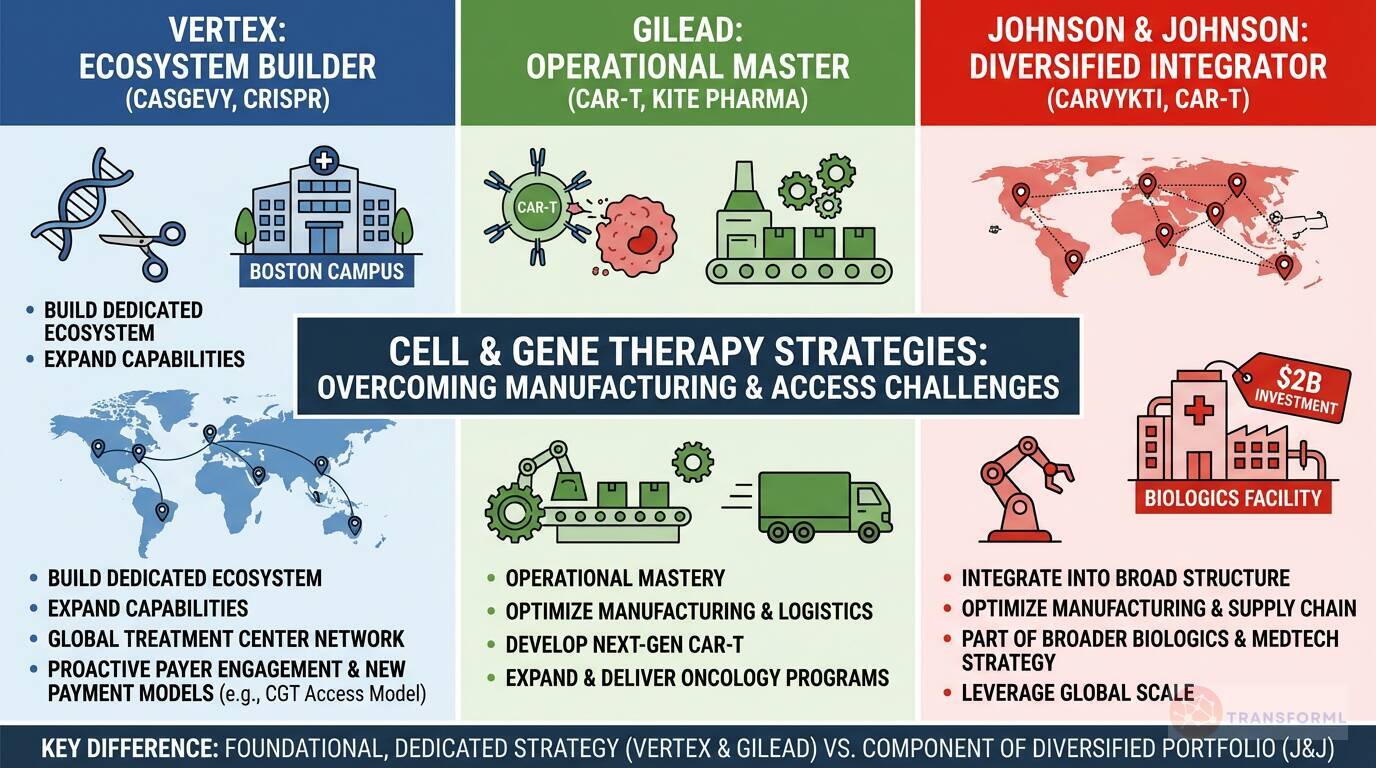

From CASGEVY to CAR-T: How are Vertex, Gilead, and Johnson & Johnson creating distinct strategies to overcome the manufacturing and access challenges of cell and gene therapy?

Vertex and Gilead are pursuing highly specialized, platform-centric strategies to lead in cell and gene therapy. Vertex, with its first-in-class CRISPR-based therapy CASGEVY, is building an entire ecosystem from the ground up. Its strategy involves significant investments to "Expand Cell and Genetic Therapy Capabilities," including a dedicated Boston campus for manufacturing, and establishing a global "network of authorized treatment centers." To tackle access, Vertex is proactively engaging with payers and participating in new payment structures like the "CGT Access Model for SCD" to help Medicaid beneficiaries. Similarly, Gilead, through its Kite Pharma acquisition, has a dedicated strategic goal to "Expand and Deliver Oncology Programs" built around CAR-T. Its focus is on operational mastery, with objectives to "Optimize Cell Therapy Manufacturing and Logistics" and "Develop Next-Generation CAR T-cell Therapies" to improve efficiency and maintain leadership.

Johnson & Johnson treats cell therapy as a critical component within its vastly larger and more diversified structure. Its CAR-T therapy, CARVYKTI, is a key growth driver, supported by a specific goal to "Optimize CARVYKTI Manufacturing and Supply Chain" to increase production capacity and reduce costs. However, this effort is part of a much broader manufacturing strategy that includes a $2 billion investment in a biologics facility and advancements in MedTech robotics. For J&J, the challenge is to integrate this highly complex modality into its existing global supply chain. This contrasts with Vertex and Gilead, for whom cell and gene therapy represents a more foundational, identity-defining strategic pillar that commands its own dedicated infrastructure.

Review detailed strategy and competitive analysis of companies in Pharma & Biotech

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.